Brighton & Hove and Oxford stand out as two of the South East’s most distinctive coworking markets, driven by strong demand from creative, digital and research-led businesses. By the end of 2025, Brighton & Hove hosts 34 coworking spaces, ranking as the 11th largest coworking hub nationally, while Oxford follows with 25 locations, ranking 13th in the UK, according to CoworkingCafe’s Q4 2025 UK & Ireland Coworking Report.

Median subscription prices in Brighton & Hove:

• Monthly memberships: £195/month, among the higher rates nationally, in line with pricing in major hubs such as Manchester, Glasgow and Nottingham, and above the £180 UK median.

• Day passes: £25/day, matching the UK median and in line with cities such as Manchester, Cardiff and Newcastle.

• Virtual office subscriptions: £73/month, more affordable than the £100 UK median, appealing to freelancers and small businesses seeking flexibility.

• Meeting rooms: £35/hour, above the £30 national median, reflecting strong demand for collaboration space.

Median subscription prices in Oxford:

• Monthly memberships: £295/month, the most expensive among major UK coworking markets, reflecting Oxford’s research- and innovation-driven economy.

• Day passes: £30/day, aligned with other premium markets such as Greater London, Edinburgh and Belfast.

• Meeting rooms: £25/hour, below the £30 UK median, offering comparatively affordable access to meeting space despite high desk prices.

National coworking market snapshot:

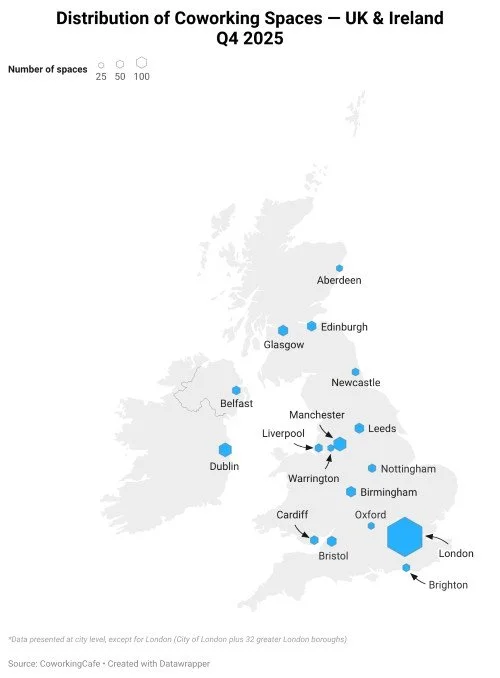

• Across the UK & Ireland, the coworking market totals 4,423 spaces, with 4,152 in the UK and 271 in Ireland.

• Within the UK, England dominates supply with 3,631 locations, followed by Scotland (297), Wales (128) and Northern Ireland (96).

• Outside London, the country’s largest coworking hubs are Manchester (128 spaces), Glasgow (68), Birmingham (66), Bristol (61) and Leeds (60).

The report draws on proprietary CoworkingCafe data as of January 1st, 2026, analysing coworking inventory, median pricing and leading operators across the UK and Ireland’s largest markets.

You can explore the full report here: https://www.coworkingcafe.com/blog/uk-ireland-coworking-report/.